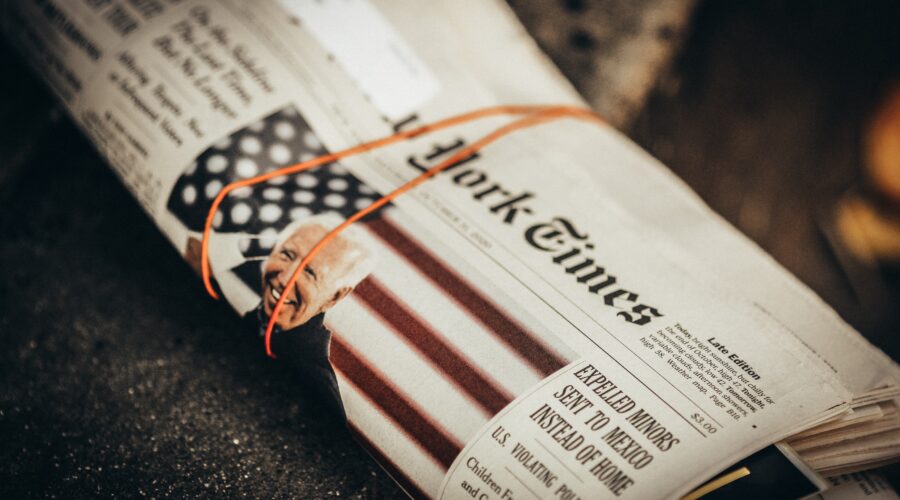

Is Joe Biden Planning to Cut Social Security Benefits?

According to the 2020 Social Security Board of Trustees report, the program is staring down a $16.8 trillion funding shortfall between 2035 and 2094. If we do not close the gap, retired workers might see their monthly benefits slashed simply to maintain program solvency in 2035. What about the nearly 65 million retirees who rely […]